restaurant food tax in pa

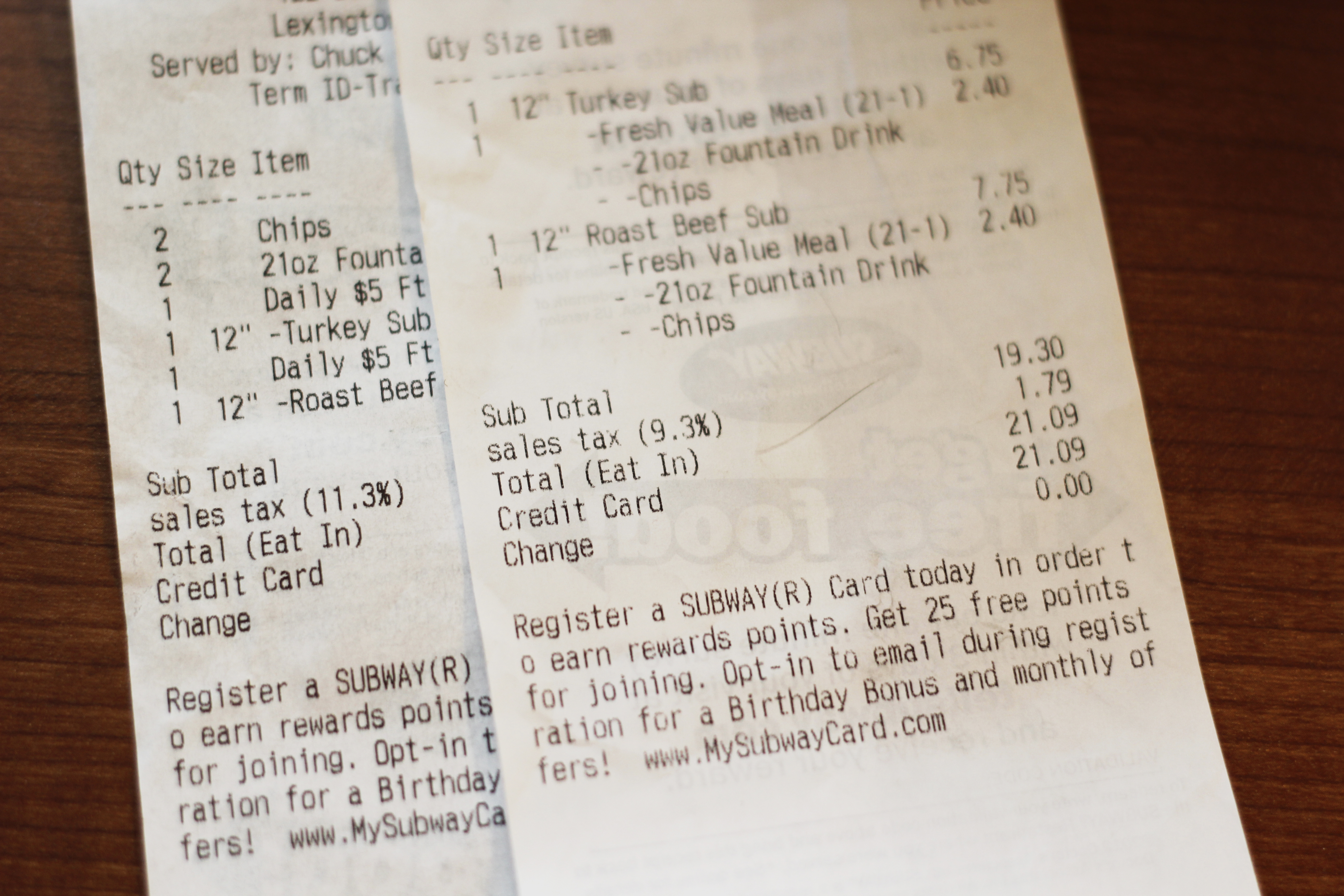

In general the sale of food and non-alcoholic beverages by a caterer or eating establishment in Pennsylvania is subject to tax regardless of whether the customer is dining in or taking out. The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634.

Family Meal Deals To Go Red Robin

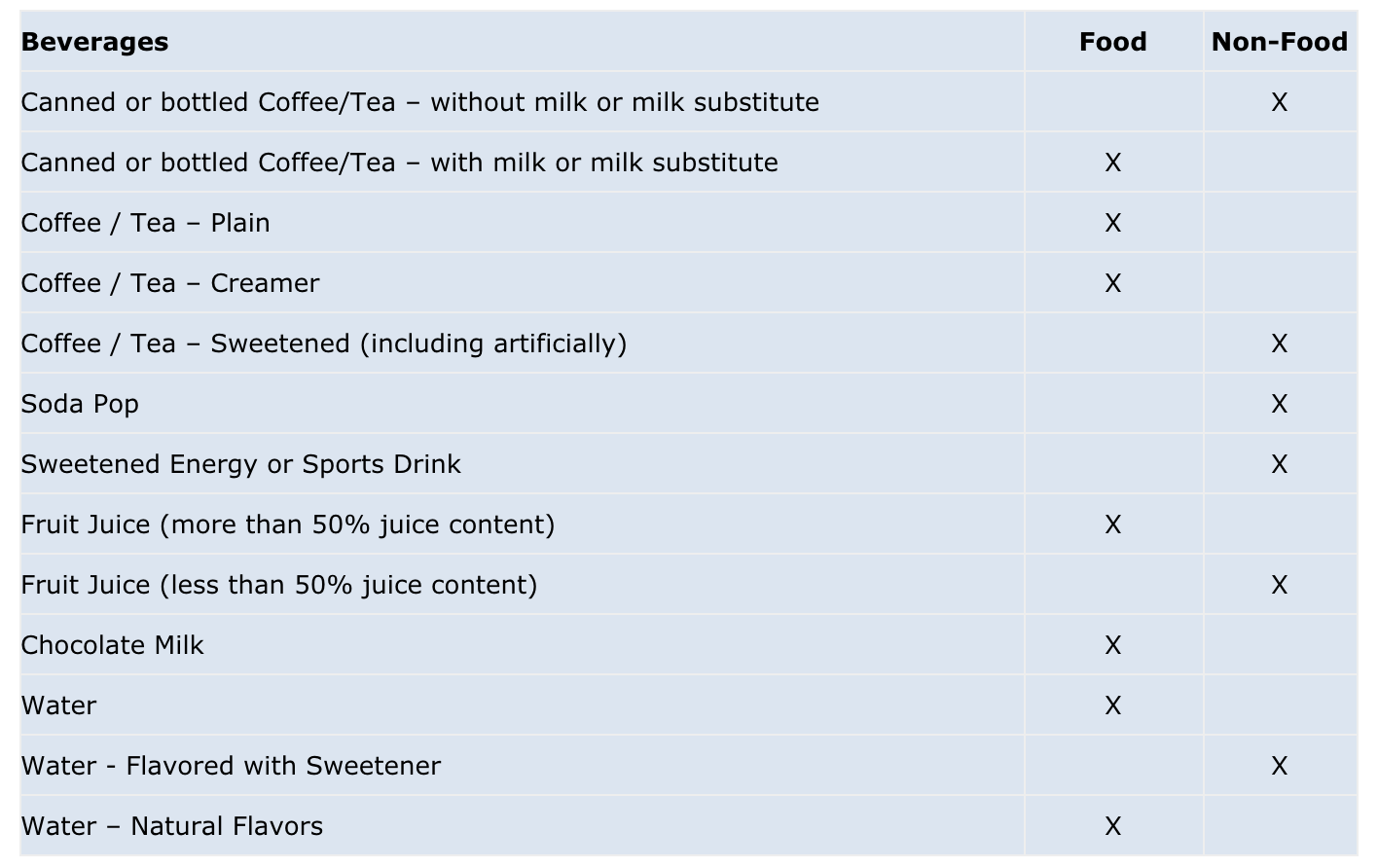

Groceries clothing prescription drugs and non-prescription drugs are exempt from the.

. If this rule applies to you and you do not separately track sales of cold food. Examples of dealers are delis restaurants and grocery stores as well as hospitals schools nonprofit groups and. A Pennsylvania Meals Tax Restaurant Tax can only be obtained through an authorized government agency.

Food 8person400 Room100 Liquor60 Floral Decorations75 50 Settings 2setting1005 Waiters 25125 1 Bartender 3535 5 tables 525 50 chairs. Grocery Food EXEMPT In the state of Pennsylvania whether. Retail food facilities are governed by Title 3 of the Consolidated Statutes Chapter 57 - Food Protection 3 CSA.

Its usually 6 on food. Generally tax is imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the purchaser or consumer when. Depending on the type of business where youre doing business and.

The Liquor Tax is applied to the sale price of alcoholic beverages purchased at bars restaurants catered events and at retail stores. Get a Food Establishment Retail Non-Permanent Location License. Burger coupon by the restaurant along with the description of the item and coupon on the register receipt establishes a new taxable purchase price of 3 which is subject to 12 cents in tax.

The sale of equipment implements other than wrapping supplies and similar tangible personal property to a restaurant for use in the preparation or. Restaurant meals and general purchases are subject to an 8 percent sales tax whereas liquor is subject to a 10 percent sales tax. It also depeneds on which area you are in because that tax can go up to 8 or even down to 1.

Clothing and food purchased at a grocery. The current rate is 10. Sale of equipment to restaurants.

PA law states that sales tax will be imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the. The 8080 rule applies when 80 of your sales are food and 80 of the food you sell is taxable. All Retail Food Facilities are regulated by The Food Code.

Catering TAXABLE In the state of Pennsylvania any gratuities that are distributed to employees are not considered to be taxable. Every sale of wine.

Pennsylvania Sales Tax Rate Rates Calculator Avalara

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation

Events At Ash S Fine Dining Reserve A Table For Luxury Food

California Sales Tax Basics For Restaurants Bars

Morning Poll Restaurant Tax To Hit 10 Percent Arlnow Com

Sales Taxes In The United States Wikipedia

Online Menu Of Three Brothers Grill Restaurant Reading Pennsylvania 19601 Zmenu

Virginia Counties Want Right To Raise Restaurant Tax Rockbridge Report

Dooley S Pub Eatery 120 Oak St Old Forge Pa Bars Mapquest

Wish You Were Here Special Page Isaac S Restaurants

The Best 10 Fast Food Restaurants Near Chambersburg Pa 17201 Last Updated October 2022 Yelp

Taxes On Food And Groceries Community Tax

Is Food Taxable In Ohio Taxjar

New Jersey Sales Tax Rate 2022

De Fer Coffee And Tea Pittsburgh Strip District Restaurant Reviews Photos Phone Number Tripadvisor

Meals Taxes In Major U S Cities Tax Foundation

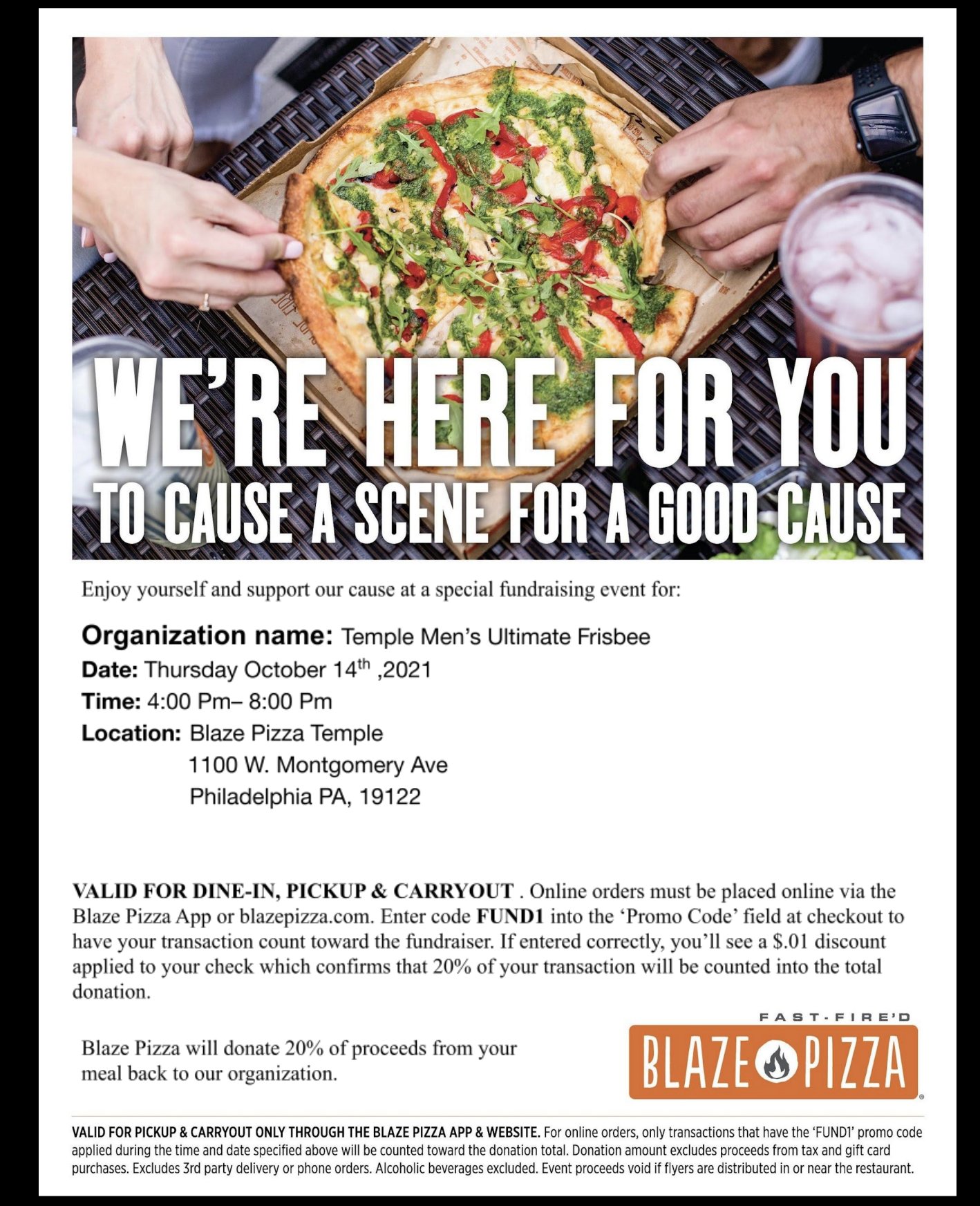

Temple Men S Ultimate On Twitter Our First Fundraiser Is At Blaze Pizza On Temples Campus Come Join Us And Eat Some Food Make Sure You Say Youre With Temple Men S Ultimate When